Introduction to passive income for college students

As a college student, I know firsthand the struggle of trying to make ends meet with a limited budget. But what if there was a way to generate income without sacrificing your study time or extracurricular activities? That’s where passive income comes in. In this article, I will guide you through the world of passive income and show you how you can create a steady stream of income while still being able to focus on your studies.

The importance of generating passive income while in college

Earning passive income while in college can have numerous benefits. First and foremost, it provides you with the financial freedom to cover your expenses without relying solely on loans or part-time jobs. This financial independence can alleviate the stress of living paycheck to paycheck and allow you to focus more on your studies and personal growth.

Additionally, generating passive income can also be a valuable learning experience. It allows you to develop essential skills such as money management, entrepreneurship, and investing. These skills will not only benefit you during your college years but also set you up for success in the future.

Benefits of earning money while in college

Earning money while in college has several advantages. Firstly, it gives you a sense of independence and empowers you to take control of your financial situation. By having your own income, you can cover your expenses, save for the future, and even invest in opportunities that may arise.

Secondly, earning money while in college allows you to gain practical experience and build your resume. Many employers value candidates who have demonstrated their ability to balance academics and work. By having a part-time job or generating passive income, you can showcase your time management, multitasking, and problem-solving skills.

Lastly, earning money while in college can provide you with a safety net. Life is unpredictable, and having a financial cushion can help you navigate unexpected expenses or emergencies without the stress of financial instability.

Different ways to earn money while in college

When it comes to earning money while in college, you have several options to explore. One of the most common ways is through part-time jobs. These can range from working at a local coffee shop or retail store to freelancing or tutoring. Part-time jobs allow you to earn money while still having the flexibility to manage your academic commitments.

Another option is to leverage your skills and talents. Are you a talented writer? Consider freelancing as a content creator or copywriter. Are you proficient in a particular subject? Offer tutoring services to your fellow students. By using your skills, you can earn money doing something you enjoy and are good at.

Additionally, you can explore online opportunities such as taking surveys, participating in paid focus groups, or selling products online. These options require minimal time investment and can be done from the comfort of your dorm room.

Exploring passive income opportunities for students

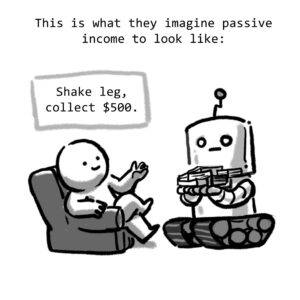

Passive income is a game-changer for college students. Unlike traditional jobs that require your constant presence, passive income allows you to earn money while you sleep. There are several passive income opportunities that are particularly suitable for students.

One option is to start a blog or YouTube channel. By creating valuable content and attracting a loyal audience, you can monetize your platform through advertising, sponsorships, or selling digital products. While it may take time to build a significant income, the potential for growth is immense.

Another passive income opportunity is affiliate marketing. This involves promoting products or services and earning a commission for every sale made through your unique referral link. Affiliate marketing can be done through a website, social media platforms, or even through email marketing.

Investing in stocks, real estate, or other financial instruments is also a viable option for generating passive income. While this may require a higher initial investment, it can provide a steady income stream over time.

How to create a passive income stream as a student

Creating a passive income stream as a student requires careful planning and execution. Here are some steps to help you get started:

- Identify your skills and interests: Determine what you are good at and what you enjoy doing. This will make it easier to choose a passive income opportunity that aligns with your strengths.

- Research potential income streams: Explore different passive income opportunities and evaluate their feasibility and potential earnings. Consider factors such as time investment, initial investment, and market demand.

- Set clear goals: Define your financial goals and how much passive income you want to generate. Having a clear vision will help you stay motivated and focused on your journey.

- Create a plan: Develop a step-by-step plan that outlines the actions you need to take to start generating passive income. This plan should include tasks such as creating a website, building an audience, or investing in stocks.

- Take action: Put your plan into action and start implementing the necessary steps. Remember that building a passive income stream takes time and effort, so be patient and persistent.

- Monitor and optimize: Continuously monitor your progress and adjust your strategies as needed. Stay up to date with industry trends and adapt your approach accordingly to maximize your earnings.

Investing in passive income opportunities for students

Investing in passive income opportunities can be a smart decision for college students. By putting your money to work, you can generate additional income without sacrificing your time or energy. Here are some investment options to consider:

- Stock market: Investing in stocks can provide a steady stream of passive income through dividends. Research different companies, diversify your portfolio, and consider long-term investments for maximum returns.

- Real estate: Purchasing rental properties or investing in real estate investment trusts (REITs) can be a lucrative passive income opportunity. Rental properties can generate monthly income, while REITs allow you to invest in properties without the hassle of being a landlord.

- Peer-to-peer lending: Platforms like Prosper and LendingClub allow you to lend money to individuals or small businesses in exchange for interest payments. This can be a great way to earn passive income while helping others achieve their financial goals.

- Dividend-paying funds: Investing in mutual funds or exchange-traded funds (ETFs) that focus on dividend-paying stocks can provide a regular income stream. Look for funds with a solid track record of consistent dividends.

Balancing passive income with academics and extracurricular activities

While generating passive income can be highly beneficial, it’s important to find a balance between your income-generating activities and your academics and extracurricular activities. Here are some tips to help you manage your time effectively:

- Prioritize your studies: Your education should always be your top priority. Make sure to allocate enough time for studying, attending classes, and completing assignments.

- Create a schedule: Develop a schedule that includes dedicated time for both your passive income activities and your academic commitments. This will help you stay organized and ensure that you are giving enough attention to each area of your life.

- Delegate and outsource: As your passive income endeavors grow, consider delegating or outsourcing tasks that can be done by others. This will free up your time and allow you to focus on the activities that require your direct involvement.

- Take advantage of technology: Use productivity tools, apps, and automation software to streamline your tasks and save time. This will help you work more efficiently and maximize your productivity.

Resources and tools for generating passive income as a student

When it comes to generating passive income as a student, there are several resources and tools available to help you along the way. Here are some recommendations:

- Wealthy Affiliate: Wealthy Affiliate is an online platform that provides training, tools, and support for affiliate marketers. It offers comprehensive courses on building successful online businesses and generating passive income.

- Udemy: Udemy is an online learning platform that offers a wide range of courses, including many on passive income generation. From blogging to affiliate marketing, you can find courses that will teach you the skills needed to create a successful passive income stream.

- Personal finance books: There are numerous books available that provide valuable insights and strategies for generating passive income. Some recommended titles include “Rich Dad Poor Dad” by Robert Kiyosaki and “The 4-Hour Workweek” by Tim Ferriss.

- Online communities and forums: Joining online communities and forums can provide you with a wealth of information and support from like-minded individuals. Reddit communities such as r/passive_income and r/financialindependence are great places to start.

Conclusion: Taking control of your finances as a college student

Generating passive income as a college student is a game-changer. It allows you to say goodbye to broke college days and take control of your financial situation. By exploring different passive income opportunities, investing wisely, and managing your time effectively, you can create a steady stream of income while still focusing on your studies and personal growth.

Remember, building a passive income stream takes time and effort, but the rewards are well worth it. Start today, embrace the opportunities available to you, and watch as your financial future becomes brighter than ever before.

Ready to start your journey to financial freedom? You can read my review of Wealthy Affiliate, the ultimate resource for creating a successful online business and generating passive income. Sign up now and take the first step towards a brighter financial future.

As an affiliate partner, we may earn commissions from qualifying purchases made through links on our website. These commissions help support the maintenance and growth of our platform, allowing us to continue providing valuable content to our audience. Rest assured, our recommendations are based solely on our genuine belief in the quality and relevance of the products or services we endorse.

best

Bernard

Co-Founder of Empower Marketing